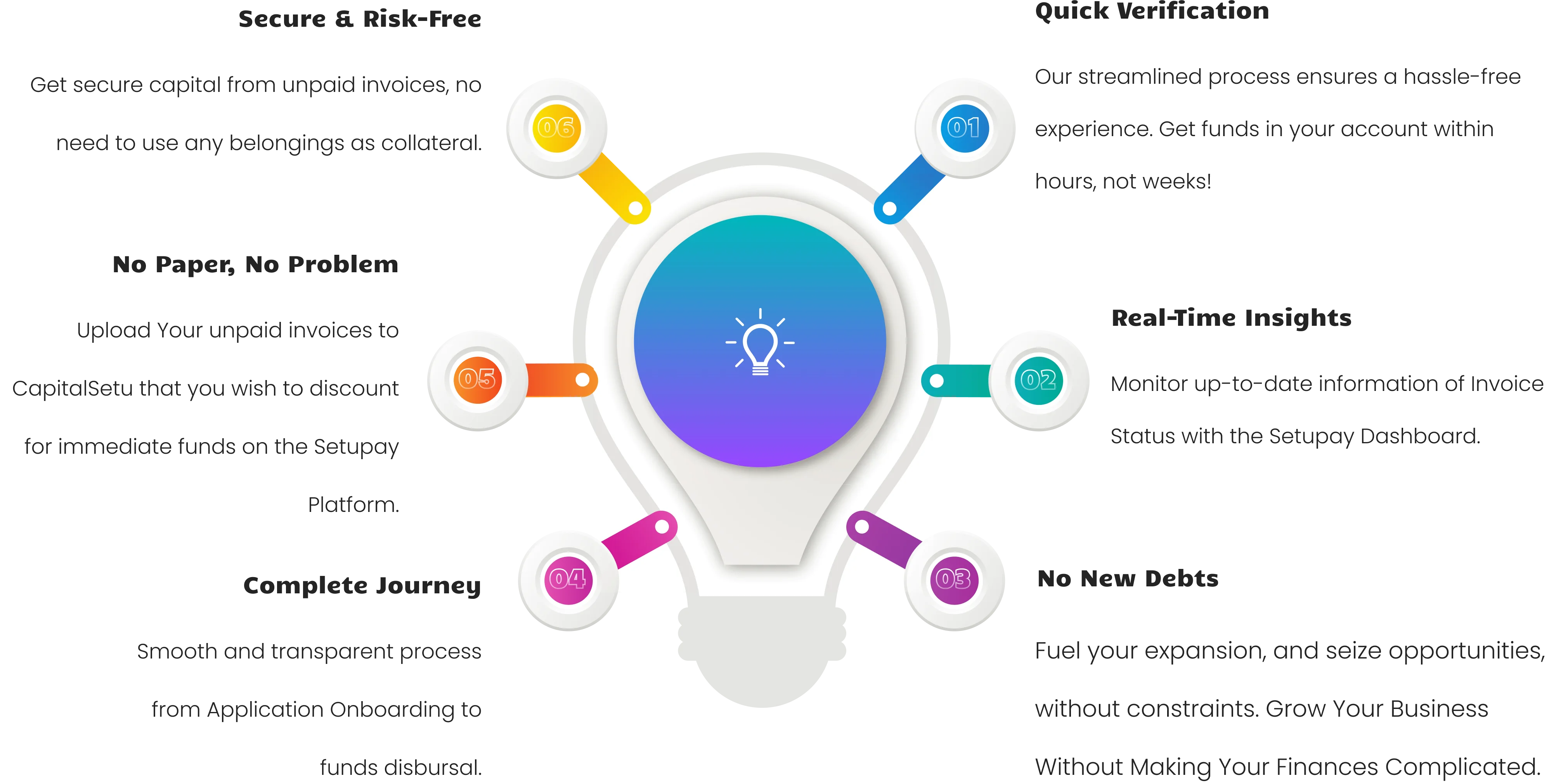

Choose SetuPay for Easy and Quick Access to Funds

Converts unpaid invoices into accessible funds, improving cash flow without incurring debt on business. risk mitigation services, allowing businesses to focus on growth.

Investor's Role in SetuPay - Invoice Discounting

This provides immediate working capital to the business. full payment with a higher return, and the business benefits from improved cash flow.

FAQ

What is invoice discounting?

Invoice discounting is a financial service which allows businesses to unlock the value of their outstanding invoices and receive early payment from a financier (CapitalSetu). It's a form of working capital finance that helps improve cash flow by converting invoices into immediate funds.

How can CapitalSetu help my business with invoice discounting?

CapitalSetu provides invoice discounting solutions that enable your business to access a percentage of the invoice value upfront. By discounting your outstanding invoices, you can receive the required funds quickly and efficiently, enhancing your cash flow and supporting your growth objectives.

Is invoice discounting the same as factoring?

While both invoice discounting and factoring involve accessing funds against outstanding invoices, they are different in how they are managed. In invoice discounting, your business retains control over the invoice collection process. In contrast, factoring involves the financier managing the collections and credit control on your behalf.

How does CapitalSetu determine the discount rate for invoice discounting?

The discount rate is determined based on various factors, including the creditworthiness of your customers, the volume of invoices being discounted, and the credit terms associated with the invoices. Our rates are competitive and designed to provide fair value while meeting your financial needs.

What types of businesses can benefit from CapitalSetu invoice discounting services?

CapitalSetu invoice discounting services are beneficial for businesses of all sizes, including SMEs and large enterprises, across various industries. Whether you are experiencing seasonal fluctuations or need to bridge cash flow gaps, our solutions can be tailored to suit your specific requirements.

How long does it take to get funds after discounting an invoice?

Upon approval of your invoice, we aim to disburse the funds quickly, usually within a few business days. Our streamlined processes and efficient operations ensure minimal delays, allowing you to access the working capital you need promptly.

Can I choose which invoices to discount?

Yes, our flexible invoice discounting solutions allow you to choose which invoices you want to discount. You have the freedom to select specific invoices based on your cash flow needs while retaining control over your customer relationships.

How do investors benefit from SetuPay?

Investors gain higher returns through SetuPay's invoice discounting, diversify portfolios, and enjoy predictable income. Shorter investment cycles provide quicker access to returns, and investors support small businesses by providing essential working capital, fostering growth.